Why UBI?

Pro-UBI arguments include its potential to improve upon the current safety net (especially given concerns about technological unemployment), and the positive effects of UBI-like programs.

UBI could address issues with the existing safety net

Ends poverty

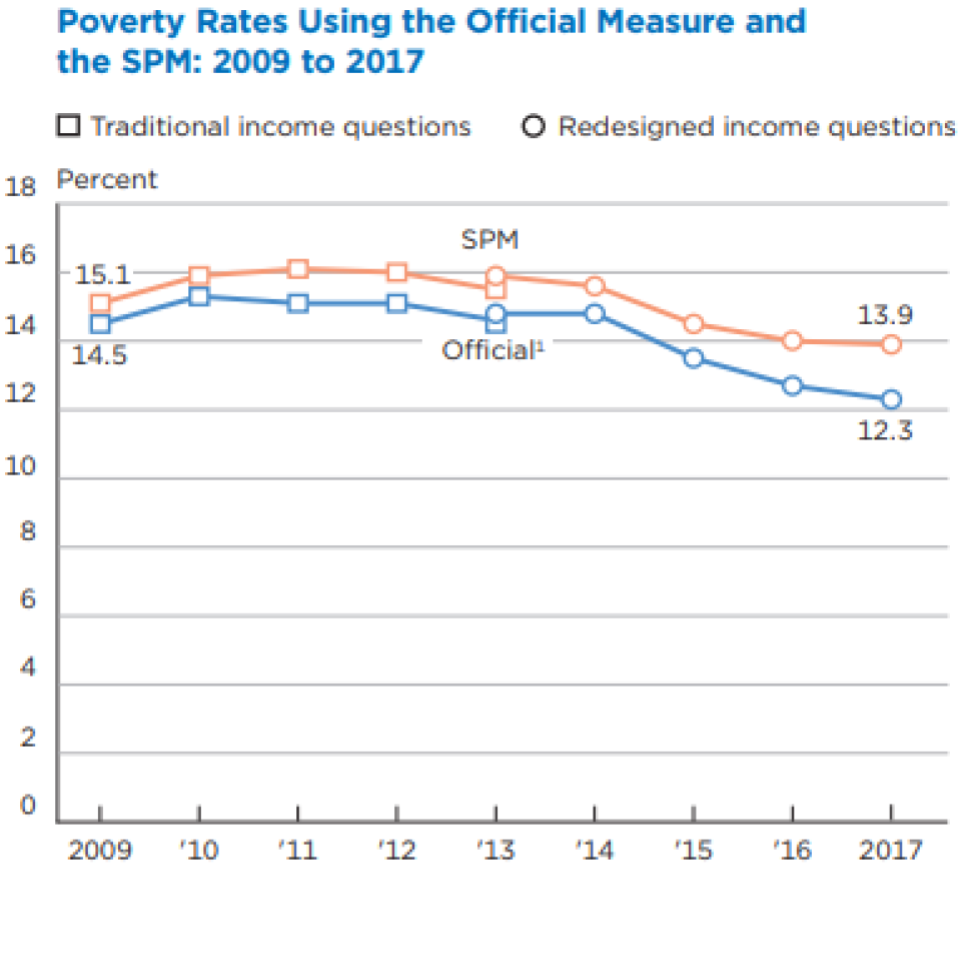

The decline of poverty has been sluggish. A sufficiently generous UBI could end it overnight.

Runs efficiently

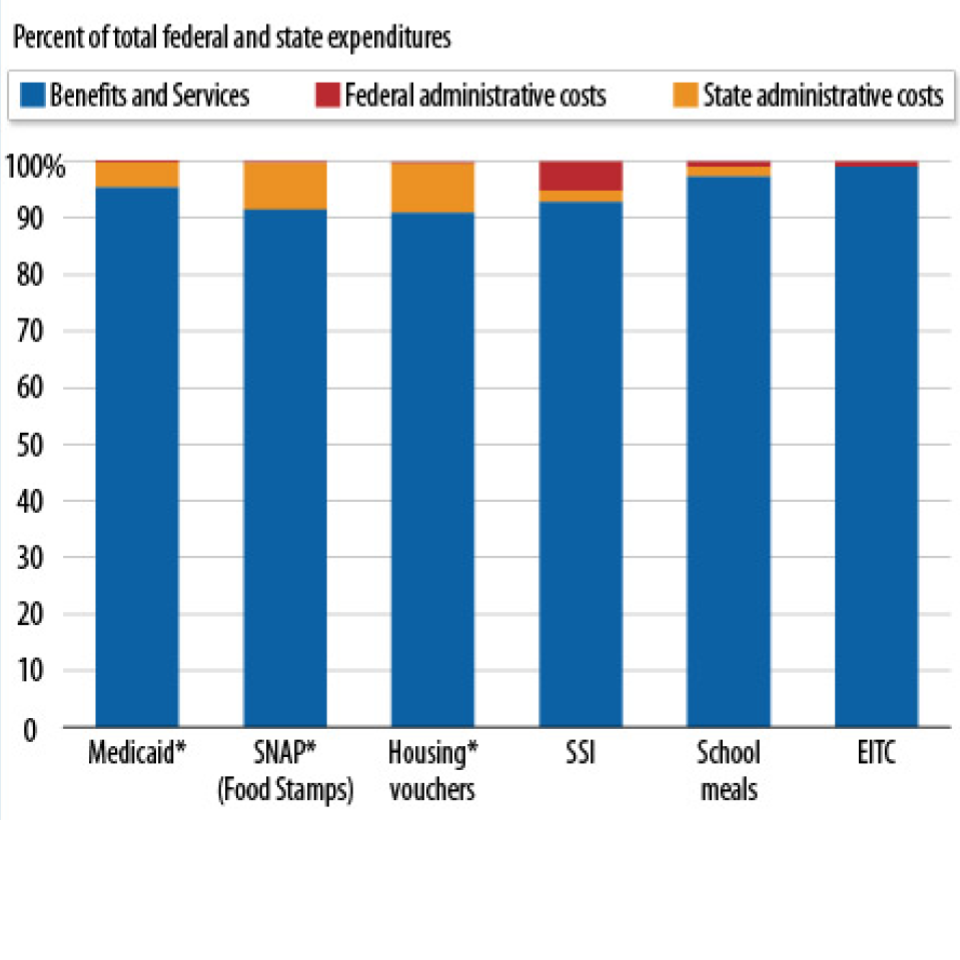

Programs like SNAP and housing vouchers cost about 10 percent in overhead, and cost recipients time applying and complying. UBI would likely cost less than 1% and involve little to no burden on recipients.

Aligns incentives

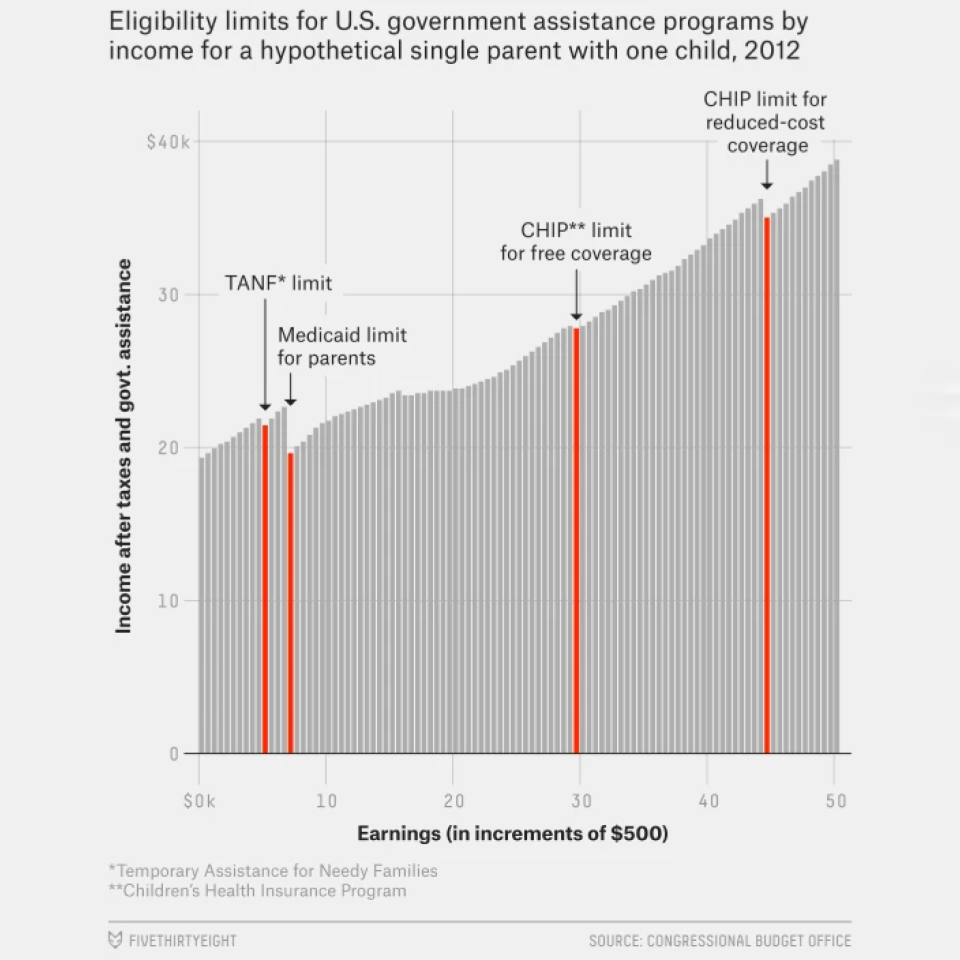

Means-tested benefits often create large marginal tax rates, including cliffs where recipients are better off not working. Under a UBI, each dollar earned raises disposable income.

Technological unemployment could widen the gap between UBI and current programs

Advocates argue that today’s safety net is built for temporary spells of unemployment, not an economy where workers need constant retraining, and call for UBI as insurance to help people adapt to a changing economy.

Safety nets already include elements of UBI

UBI is fundamentally about creating an inclusive, cash-oriented safety net. Many safety net programs incorporate these features.

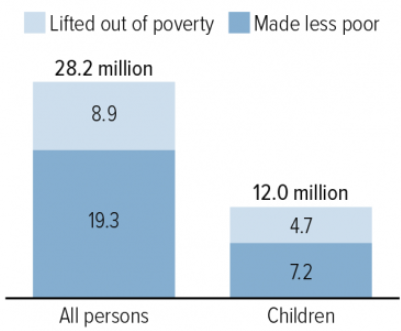

Refundable tax credits lift millions of Americans out of poverty

The Earned Income Tax Credit (EITC) and Child Tax Credit (CTC) are cash antipoverty tools with bipartisan support. The 2017 Republican tax cut expanded the CTC, while Democrats have proposed a nearly-universal child allowance. Democrats have also introduced the LIFT+ Act, which would expand the EITC to families with low or no earnings, and both parties have called for expanding EITC for childless workers.

Alaska has had a small UBI for decades

Alaska’s Permanent Fund, which invests the state’s oil revenues, pays out a share of interest to each Alaskan. The Permanent Fund Dividend has ranged from $1,000 to $3,000 per person per year since its introduction in 1982.

Berman and Reamey (2016) estimate that the program has reduced Alaska’s poverty by 20 percent, and Jones and Marinescu (2018) estimate that it has “had no effect on employment, and increased part-time work by 1.8 percentage points (17 percent).” A 2017 survey found that 78 percent of Alaskans view the program favorably.

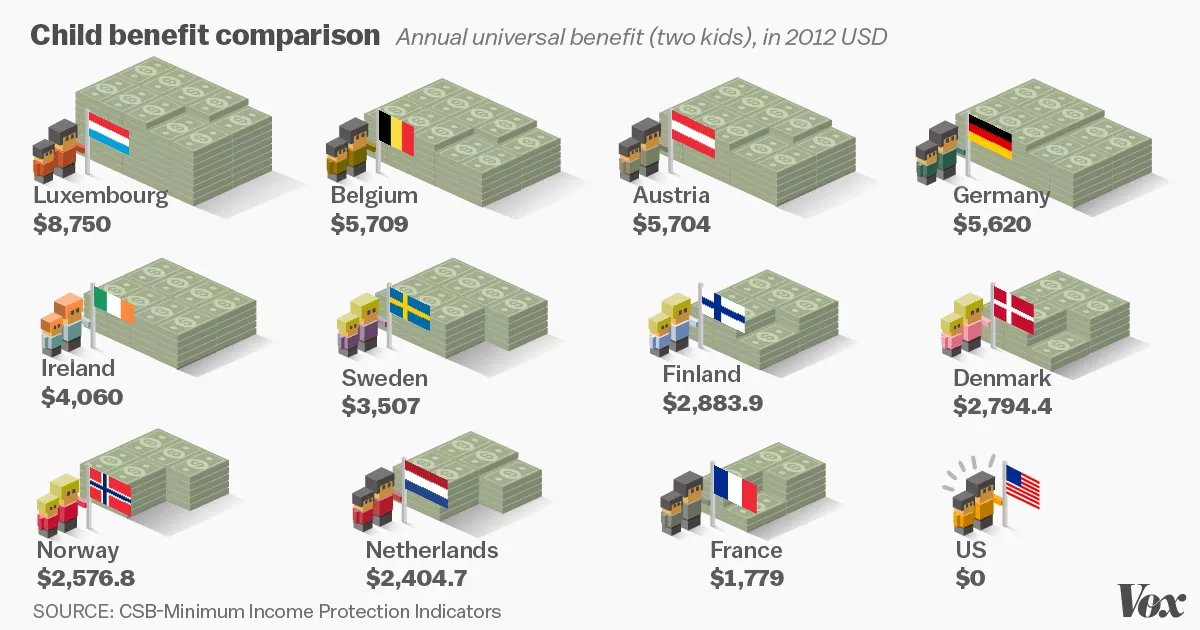

Many developed countries have cash benefits for children

Canada and most European countries give child allowances, and Ireland and Sweden give flat amounts for every child–a true UBI for children

Cash transfers improve a large set of outcomes

High-quality evidence, including randomized controlled trials, and spanning low- and high-income countries, have shown that cash transfers

- Raise earnings

- Reduce health risks like low birth weight, HIV infection, psychological distress, and malnutrition

- Increase schooling and decrease child labor

- Don’t affect spending on alcohol and tobacco

- Improve family cohesion by raising the time mothers spend with children and reduce risk of new parents breaking up

- Lengthen life expectancy