The Inflation Reduction Act discourages electric vehicle buyers from working

Last week, Senators Chuck Schumer (D-NY) and Joe Manchin (D-WV) announced an agreement to add the Inflation Reduction Act (IRA) to the FY2022 Budget Reconciliation bill. The legislation reforms taxes and prescription drug pricing and funds healthcare and energy programs, including new and expanded tax credits for electric vehicle (EV) purchases.

The US first established EV tax credits in 2005, and current law has been on the books since 2008. Today, these tax credits range from $2,500 to $7,500, though EV buyers can only claim the credit if purchasing from a manufacturer that hasn’t exceeded certain EV production limits. Tesla and GM have surpassed their limits, so purchases of their vehicles no longer qualify for the credit, and Toyota credits will phase out over the next year.

The IRA scraps those manufacturer limits and sets the credit at a flat $7,500 for vehicles with batteries made in North America and MSRPs below certain limits. It also creates a new tax credit for the purchase of used EVs bought for under $25,000, set at the lesser of $4,000 and 30% of the sale price. Congress estimates that the new and used EV credits will cost $7.5 billion and $1.3 billion over the next decade, respectively.

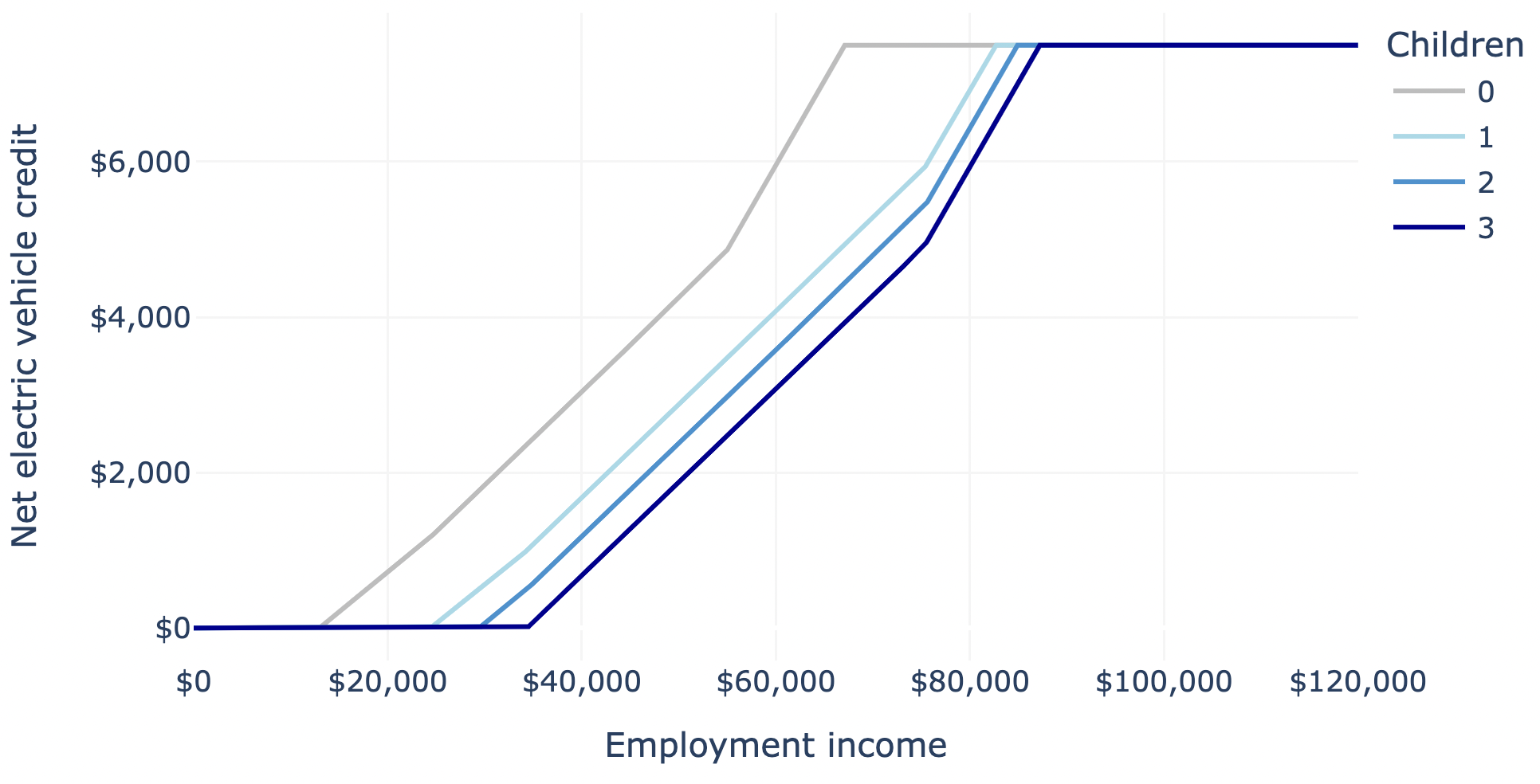

Both the new and existing EV credits are non-refundable, meaning that they can’t reduce a filer’s tax liability below zero. As a result, they provide no or partial value to low-income filers.

Figure 1: Net tax benefit to an unmarried filer from purchasing a high-capacity electric vehicle under current law

In addition, the IRA makes taxpayers ineligible for EV credits if their income exceeds limits shown in the table below.1 For example, a single filer who purchases a new EV will receive a $7,500 credit if they earn $150,000, but $0 if they earn $150,001.

Table 1: Electric vehicle tax credits under the Inflation Reduction Act

| EV type | Amount | Vehicle price limit | Income limit |

|---|---|---|---|

| New | $7,500 | $80,000 (vans, SUVs, trucks) $55,000 (other) |

$150,000 (single) $225,000 (head of household) $300,000 (joint) |

| Used | Lesser of $4,000 and 30% of sale price |

$25,000 | $75,000 (single) $125,000 (head of household) $150,000 (joint) |

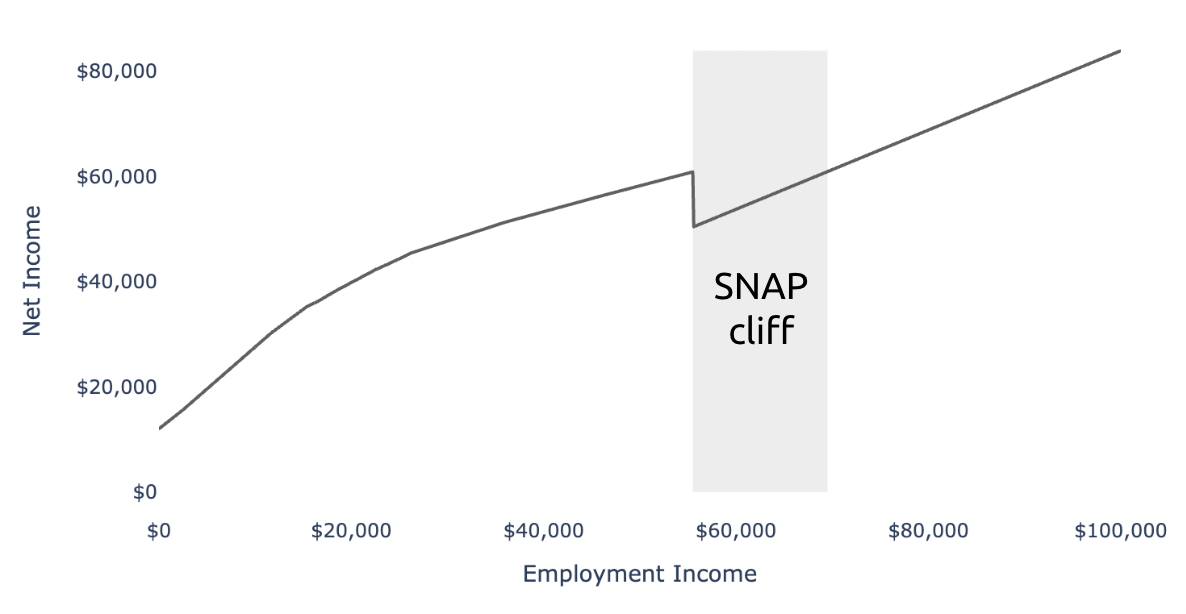

These immediate losses of benefits over a threshold are known as “benefit cliffs,” and as I wrote in an analysis of a cash assistance proposal in Cambridge, Massachusetts, they can require thousands of dollars of additional earnings to escape. For example, a Massachusetts family of four today loses about $10,400 when they earn above 200% of the poverty line, or about $55,500. This cliff is largely due to their ineligibility for the Supplemental Nutrition Assistance Program, which Massachusetts and other states have temporarily expanded due to Covid-19. To return to their net income before the benefit cliff, they would have to increase their earnings to $69,500. I called this $14,000 gap the “earnings dead zone.”

Figure 2: How earnings affect net income for a Massachusetts family with two parents and two children under current law

Similarly, the IRA’s EV credits create earnings dead zones for EV purchasers. Using PolicyEngine, a free open-source app for tax and benefit analysis, I’ve calculated the size of these earnings dead zones for different household types.

Consider that same family of four living in Massachusetts. If they purchase a used EV for $20,000 and earn $150,000, they are eligible for the full $4,000 tax credit. Their income after other taxes and benefits is $117,700, bringing their total net income to $121,700. But if they earn $150,001, they lose the full $4,000 tax credit, and their net income falls back to $117,700. To return to $121,700 net income, they would have to earn $155,600. The EV credit creates an earnings dead zone for this household $5,600 wide.

Figure 3: How earnings affect net income for a Massachusetts family with two parents and two children purchasing a used electric vehicle under the Inflation Reduction Act

Depending on the household’s state and structure, EV tax credits create earnings dead zones ranging from about $5,000 to $6,000 for the used EVs to about $10,000 to $11,000 for new EVs.2

Table 2: Earnings dead zones in the Inflation Reduction Act for various households and EV purchases

| Household | State | Earnings dead zone | |

| Used EV | New EV | ||

| Family of four | MA | $5,600 | $11,000 |

| Family of four | MD | $6,000 | $11,100 |

| Family of four | WA | $5,300 | $10,200 |

| Single person | MA | $6,200 | $10,800 |

| Single person | MD | $6,100 | $11,000 |

| Single person | WA | $5,700 | $10,100 |

Policymakers understandably want to maximize benefits to lower-income households and the environment using finite resources. If richer households are less price-elastic toward EVs, then restricting the credits may promote EV ownership more per dollar. While analysts have not yet broken out emissions impacts by IRA provision, several project that the full bill would reduce greenhouse gas emissions by 10–20% by 2030.3

Potential EV buyers will likely consider the policy’s structure not only when making purchase decisions, but also labor supply decisions. While more research would improve predictions of labor supply effects for specific policies like these, studies consistently show that people respond to tax and benefit structures that affect their take-home pay. As policymakers consider opportunities to reverse perverse incentives and unfairness of benefit cliffs in existing laws, they should also take caution to avoid introducing new ones.

Thanks to Rick Evans, Megan Jenkins, and Erica Royer at the Center for Growth and Opportunity for their valuable feedback on this report. The CGO supports state tax models used in parts of this analysis.

-

The IRA’s EV tax credit income definition is the lesser of their modified adjusted gross income in the year of purchase and the prior year. It also allows buyers to claim the credit at the dealer. In this analysis, I assume that filers have equal income in the current and prior year, and claim the credit on their tax returns rather than at the dealer. ↩

-

Assumes all income is from one earner’s wages, that used EVs are purchased for between $13,333 and $25,000 (such that the credit provides $4,000), and that the new EVs meet current and IRA conditions. ↩

-

The Rhodium Group projects that US emissions would be 24-35% below 2005 levels by 2030 under business as usual (BAU), and 31-44% below 2005 levels under the IRA; this corresponds to a 9-14% reduction. Energy Innovation projects 24% below 2005 levels by 2030 under BAU and 39% under their IRA moderate scenario; this corresponds to a 20% reduction. The REPEAT Project projects 26% below 2005 levels by 2030 under BAU and 41% under the IRA; this corresponds to a 20% reduction. ↩

Subscribe to the UBI Center

Get the latest posts delivered right to your inbox